The smart Trick of First Data Merchant Services That Nobody is Discussing

Wiki Article

6 Simple Techniques For Credit Card Processing Fees

Table of ContentsUnknown Facts About Square Credit Card ProcessingThe Only Guide for Merchant ServicesPayment Solutions Things To Know Before You Get ThisExcitement About Credit Card ProcessingGetting My Credit Card Processing Fees To WorkThe Main Principles Of Payment Solutions Not known Facts About Clover GoThe Ultimate Guide To Clover GoThe Buzz on Payment Solutions

The B2B payments area is pretty crowded. Several financial institutions, fintech companies, as well as industry professionals use B2B settlements systems, as well as new companies are going into the area frequently. We looked into the choices, and also here are several of the most effective B2B repayment services: Best for: B2B organizations that purchase or sell on internet terms.9% handling charge (comparable to what Pay, Pal and Square fee for charge card repayments). The purchaser has 60 days to pay Fundbox, rate of interest free. After 60 days, the buyer can expand terms for as much as one year, for a flat weekly charge. There's likewise check out functionality with Fundbox Pay.

The Only Guide for Payment Hub

Fundbox Pay's B2B solutions essentially move the danger of the purchaser not paying far from the vendor. This resembles the usage of charge card in the consumer space. When someone goes to a dining establishment or gets a motion picture ticket with a bank card, the merchant makes money right now, and the consumer delays repayment for a payment cycle.

Comdata Payment Solutions - Questions

Pay, Chum is a heavyweight in the B2B repayments sector. All they have to do is click the "pay" button, and also they can pay with their Pay, Pal equilibrium, a linked financial institution account, or a credit or debit card.

8 Simple Techniques For Online Payment Solutions

Quick, Publications also provides a B2B settlement remedy that functions in a similar way to Square as well as Pay, Chum.Best for: B2B purchasers that desire to systematize payments with a credit report card. One factor that taking care of B2B payments is challenging is that different vendors favor various settlement approaches.

The 20-Second Trick For Credit Card Processing Companies

Trade, Gecko is a supply and order management company, but additionally uses durable B2B settlements remedies. They also provide a payment gateway for wholesale customers.

Our Payeezy Gateway Ideas

Whichever B2B settlement solution you pick, a lot of small company owners discover themselves on the paying end and also receiving end. Right here are some best methods when you're the buyer: Clear your accounts payable equilibrium by paying right after the deal. Utilize a bank card to pay if you require more time to integrate the expense.Use your favorable repayment background to bargain favorable terms advice with new providers. Here are some ideal techniques when you're the seller: Send out a billing or repayment request right after the deal.

The Facts About First Data Merchant Services Uncovered

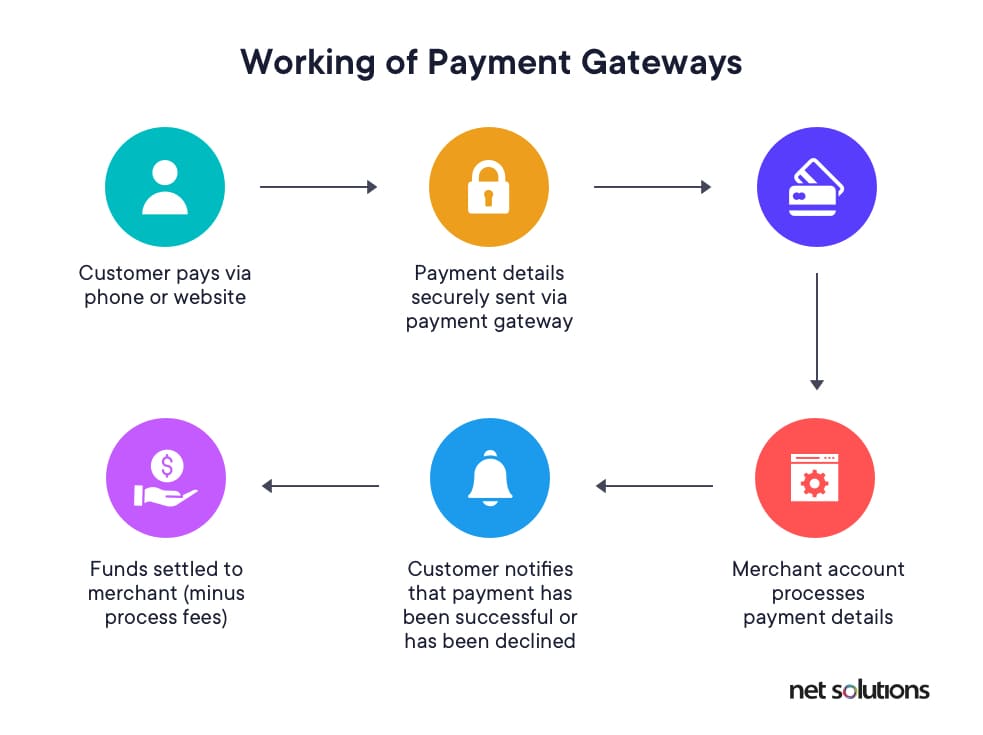

What do settlement processing companies suggest when they claim "settlement pile?"Put simply, a payment pile is all the elements required to develop an on the internet settlement remedy. There's a range of payment methods, processes as well as stakeholders required to produce an efficient remedy for processing repayments online. This overview will help you to recognize the components of a settlement pile as well as the principles you need to understand.What are the Components of a Payment Heap?"The term "settlement pile' is used to refer to all the modern technologies and parts that a company makes use of to accept payments from consumers.

Payment Solutions Fundamentals Explained

These are some of the elements of a payment pile that interact to create a smooth business experience for organizations, banks and also customers. Fraudulence Avoidance, As technology remains to advance, deceptive task proceeds to develop. It ought to come as no shock that stores and various other organizations are experiencing even more data breaches than ever in the past.It's ideal to maintain a record of every transaction within the company by utilizing bookkeeping software program, however additionally outside of the firm. This is done by checking records with the financial institutions that tape the purchases. If a mistake is made, simply straighten your firm's documents with financial institution statements to locate the try this website source of an error.

An Unbiased View of Credit Card Processing Fees

Check out Interface, An excellent check out interface makes it easy for consumers to see pricing in their regional money and also to find and utilize their recommended local settlement techniques. The check out interface is an important part of your site experience as well as essential for ensuring you don't lose consumers that want to acquire from you.Report this wiki page